Know your customer

Knowledge is power, as the phrase goes, so make sure you use it wisely. Check the exact name and legal status (you will need this if you ever have to take legal action to recover a debt) · Use headed paper to verify company details · Make sure the order is from the same entity · Use a […]

Just the Tip of the Credit – Berg

When you look into giving a customer credit, how deep do you look into their current financial strength? How far into your customer’s finances do you go? How often do you go back and look again? And when you’re not looking, who is looking out for you? With a Credit Insurance policy, you not only […]

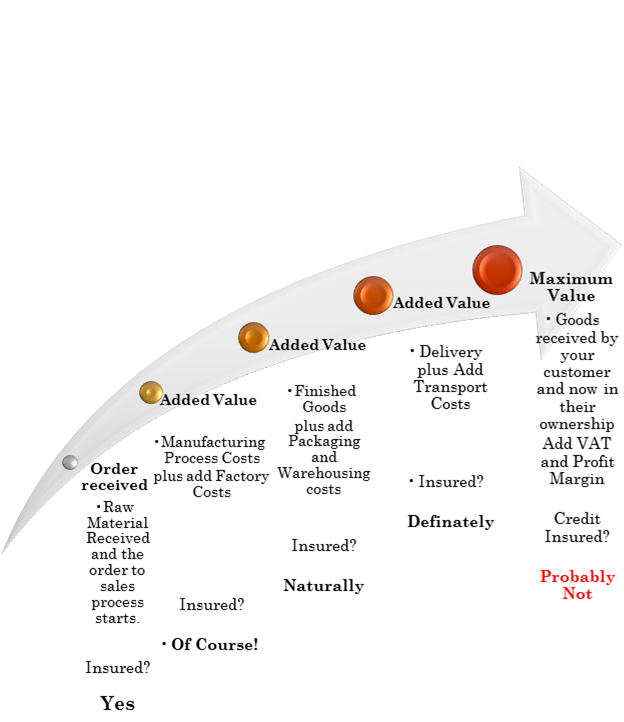

From Order to Getting Paid – The Manufacturing Process

You will no doubt as a matter of course insure many of your business assets such as buildings, machinery, stock and vehicles. You will more than likely have insurance in place to cover against business interruption, employer’s liability, fire, theft. The list can go on. The biggest asset in your balance sheet, your debtors, may […]

Prevention or Cure?

Sometimes the best examples of the benefits of Credit Insurance have nothing to do with customers going bust and owing you money. Consider the owner of a timber yard. Every day he loads up other peoples lorries for them to take his timber away and use it in their construction businesses, making furniture and joinery […]

You can check and double check or be part of a Credit Intelligence Network

How many times do you check your customer’s creditworthiness? How often do you check? What information do you use to check them? What do you look for and what information do you use? How much time do you have to continually monitor? In today’s busy work place we are all trying to do several different […]

The Tip of the “Credit – Berg”.

When you look into giving a customer credit, how deep do you look into their current financial strength? How far into your customer’s finances do you go? How often do you go back and look again? And when you’re not looking, who is looking out for you? With a Credit Insurance policy, you not only […]

BHS – Company Voluntary Arrangement

The fall out from this high street failure is not only the immediate loss incurred by anyone of the creditors but the loss of future sales by those suppliers. While many may be Credit Insured and looking to claim up to 90% of the debt back, there are those who are not insured and their […]